Bitcoin & Ether

Structured Note

Investments

Bespoke, principal-hedged crypto investment products for accredited and high-net-worth clients. Regulator approved.

Bitcoin & Ether

Structured Note

Investments

Bespoke, principal-hedged crypto investment products for accredited and high-net-worth clients. Regulator approved.

Volatility Labs Inc. ("Fig Investments"), a Canadian fintech company, is thrilled to announce that David Schaffner, CFA, has signed on as a Strategic Advisor. Schaffner is poised to provide invaluable guidance with his wealth of knowledge and distinguished career in asset and wealth management as the startup embarks on its next phase of growth in democratizing the structured products market.

Fig Investments, a regulated Bitcoin and Ether structured notes platform based in Canada, and Uniblock, the first unified API for Web3, are excited to announce a partnership to develop an on-chain derivatives settlement protocol.

Volatility Labs Inc. dba Fig Investments ("Fig" or "Fig Investments") is excited to announce that it has received exemptive relief from the Alberta Securities Commission (ASC) and British Columbia Securities Commission (BCSC) to permit distribution of its novel crypto structured investment products to accredited investors.

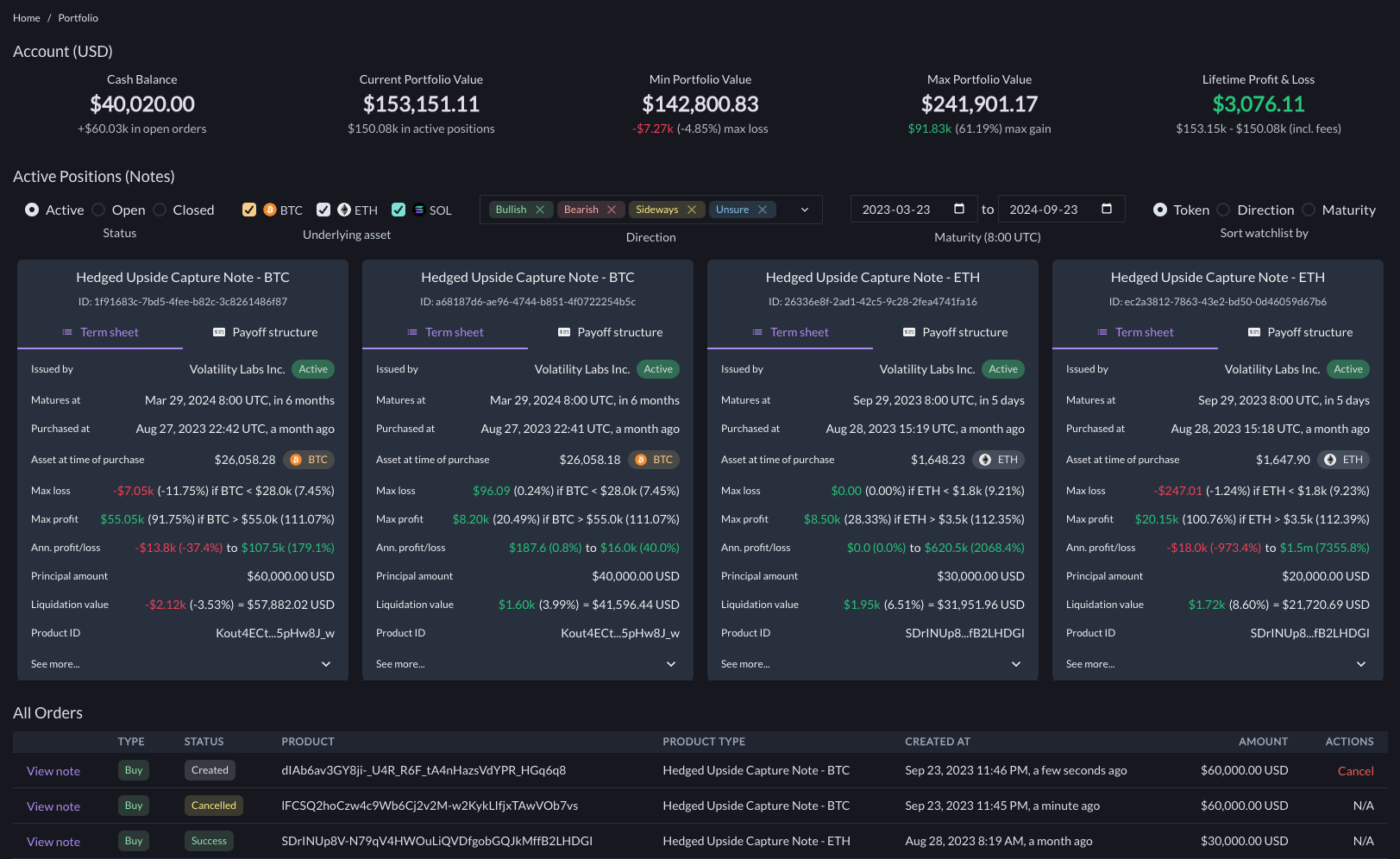

Easy access to derivatives & options

Our notes define a payout structures up front. Know the boundaries across your overall portfolio at all times.

Principal Hedged

Our notes accomplish principal-hedging through the use of quantitative derivatives strategies. This allows us to define a payout structure upfront.

"Structured products uniquely allow investors to strike a balance between risk and reward. By tailoring solutions to specific market views and risk appetites, we empower our clients to navigate market uncertainties with confidence."

Bespoke & Customized

All our notes are structured one-off for each individual and their mandates in a matter of seconds.

"We're advancing structured notes distribution using the robust, cutting-edge technology you'd find at big-tech."